Tax Efficiency Strategies

![]()

No matter how good the return on your investments is, that return is only as

valuable as the amount you are able to keep, after taxes.

For this reason, Atlantic Financial focuses on helping our clients take

advantage of the latest tax strategies and tax savings strategies.

For more information, please call.

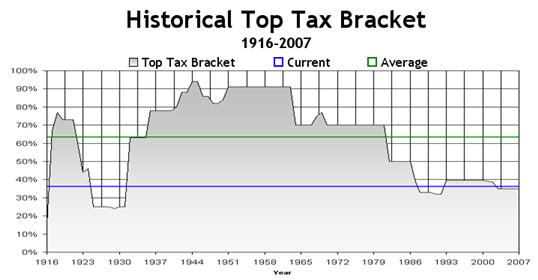

The Reality of the Tax Bite - Do you know the historical rate of taxes?

Do you know what your tax bracket will look like in 10 years?

While most investors realize that the highest tax bracket has been over 50%

many times in history, today many investors forget that historically the rate

has been over 70% many times in American history.

For two years (1943 and 1944) the top tax bracket rate actually topped 90

percent.

There are several factors that could contribute to increased taxes over the coming years as the huge generation of baby boomers retires:

retirees typically earn less income and therefore pay less in taxes - leaving less of a tax base for the government to work with

retirees draw from the system in the form of Medicaid, Medicare, Social Security and unfortunately for many retirees, welfare - causing an increase in expenses

the next generation behind the baby boomers, Generation X, only has a small number of members - causing the government to have less citizens to tax

retirees typically spend less than when they are working - this causes a decrease in consumer spending and is harmful to the economy

Given these four factors, do you think taxes will be higher or lower than the historical average as you draw from your retirement funds?

If you agree that there is a chance that they will be higher than the

historical average, you could find yourself paying as much as 70% in Federal

Income tax during your retirement years.

It will be important to have a

good tax strategy in place when looking at your retirement planning and your

financial planning.

Do you have a tax strategy for your retirement plan?